An Unbiased View of Pkf Advisory Services

An Unbiased View of Pkf Advisory Services

Blog Article

Pkf Advisory Services Things To Know Before You Get This

Table of ContentsThe Single Strategy To Use For Pkf Advisory ServicesSome Known Details About Pkf Advisory Services The Definitive Guide to Pkf Advisory ServicesPkf Advisory Services Can Be Fun For EveryoneA Biased View of Pkf Advisory Services

Lots of people nowadays know that they can not depend on the state for even more than the absolute basics. Planning for retired life is a complicated business, and there are several alternatives available. A monetary adviser will not just help look through the lots of rules and product options and assist build a profile to maximise your long term leads.

Purchasing a residence is one of the most pricey choices we make and the large bulk people require a mortgage. A monetary consultant can save you thousands, especially sometimes like this. Not only can they choose the very best prices, they can aid you assess reasonable levels of borrowing, make the most of your deposit, and may additionally locate loan providers who would or else not be readily available to you.

Everything about Pkf Advisory Services

An economic consultant recognizes just how items operate in different markets and will identify feasible downsides for you along with the possible advantages, to ensure that you can after that make an educated choice concerning where to invest. Once your risk and financial investment analyses are full, the following step is to look at tax; even one of the most fundamental summary of your setting might help.

For extra challenging plans, it could suggest relocating possessions to your partner or kids to maximise their individual allowances rather - PKF Advisory Services. A monetary advisor will constantly have your tax setting in mind when making recommendations and factor you in the ideal direction also in complex situations. Even when your financial investments have actually been placed in location and are going to plan, they need to be monitored in instance market developments or uncommon events push them off program

They can examine their performance versus their peers, guarantee that your asset appropriation does not come to be distorted as markets rise and fall and assist you combine gains as the deadlines for your best goals relocate better. Money is a complicated topic and there is great deals to take into consideration to shield it and maximize it.

The 5-Second Trick For Pkf Advisory Services

Utilizing an excellent economic adviser can article source reduce through the hype to steer you in the best instructions. Whether you require basic, useful suggestions or an expert with devoted know-how, you could discover that in the long-term the cash you buy expert guidance will certainly be repaid often times over.

Keeping these licenses and qualifications calls for continuous education and learning, which can be costly and taxing. Financial advisors need to remain upgraded with the most recent sector fads, laws, and ideal techniques to offer their clients efficiently. Regardless of these difficulties, being a licensed and licensed monetary consultant provides immense advantages, consisting of numerous job possibilities and greater making possibility.

The Buzz on Pkf Advisory Services

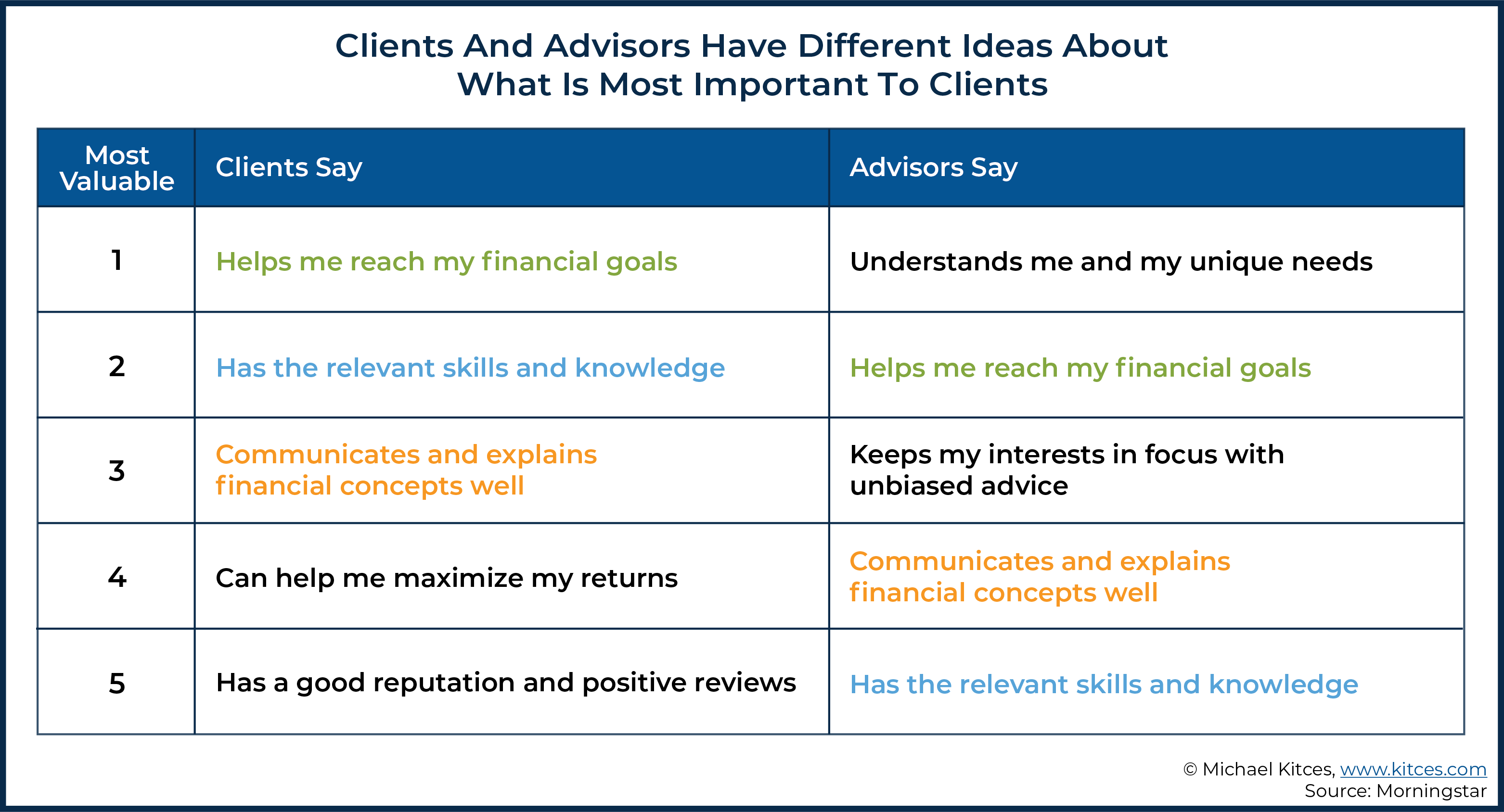

Compassion, analytical abilities, behavioral finance, and outstanding communication are extremely important. Financial consultants function very closely with clients from varied backgrounds, aiding them navigate intricate monetary choices. The capability to pay attention, comprehend their unique demands, and offer customized advice makes all the distinction. Interestingly, previous experience in finance isn't always a requirement for success in this area.

I started my profession in corporate finance, moving about and upwards throughout the corporate financing framework to hone skills that prepared me for the function I remain in today. My choice to move from business money to individual finance was driven by personal requirements along with the need to aid the numerous people, family members, and tiny companies I currently offer! Attaining a healthy work-life balance can be challenging in the early years of a monetary expert's job.

The monetary consultatory profession has a positive outlook. This growth is driven by variables such as an aging populace requiring retirement preparation and raised recognition of the you can try this out value of financial planning.

Financial consultants have the one-of-a-kind capacity to make a significant effect on their customers' lives, aiding them original site accomplish their financial objectives and safeguard their futures. If you're passionate about money and assisting others, this career course may be the best fit for you - PKF Advisory Services. To review even more information concerning ending up being a financial advisor, download our comprehensive frequently asked question sheet

The 25-Second Trick For Pkf Advisory Services

If you would like investment guidance concerning your details realities and circumstances, please call a professional financial advisor. Any investment involves some degree of danger, and different types of investments involve varying degrees of risk, including loss of principal.

Past performance of any safety, indices, technique or appropriation may not be a sign of future results. The historical and existing info as to rules, regulations, standards or advantages had in this record is a recap of details gotten from or prepared by other sources. It has not been independently validated, however was acquired from sources believed to be reliable.

An economic consultant's most valuable property is not proficiency, experience, or perhaps the capacity to produce returns for clients. It's trust, the structure of any type of successful advisor-client partnership. It sets an advisor in addition to the competitors and maintains clients coming back. Financial experts across the country we interviewed concurred that count on is the key to constructing long lasting, effective connections with clients.

Report this page